As the label implies, brand new Less than perfect credit Fund system try especially situated with the members that have low credit ratings, providing them a simple possible opportunity to be eligible for a no borrowing glance at loan. It acts as a joining representative ranging from individuals and you can loan providers, giving amazing financing levels of around $ even although you has a poor credit rating.

Because it’s buyers based, this service membership just needs very first advice within the online software one any type of consumer also provide. It’s a trustworthy platform, assaulting up against deceptive loan providers by elevating awareness of the risks from scamming fund.

Bad credit Fund employs higher-security features in provider and you will web site to reinforce the reliability. Everything you fill in towards software is encrypted and you may leftover safer on platform’s servers until you select you need they removed.

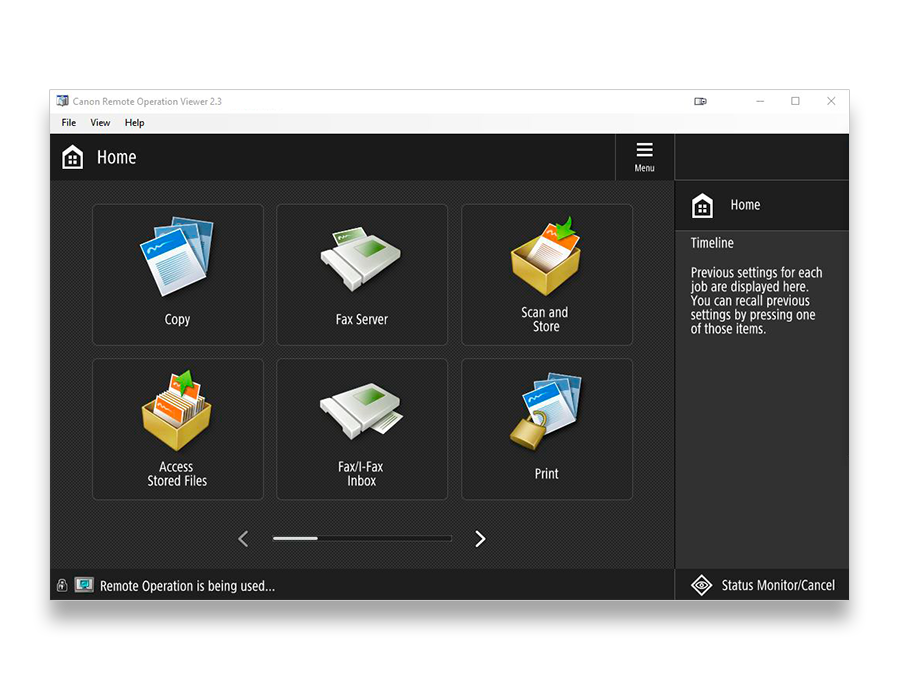

The Bad credit Fund service provides one of the best and simplest website designs out of all lending platforms. Everything on the website is simplified and intuitive, so clients can easily find their way around without hassle and misinformation.

Right away, this service membership goes right to the idea, asking you the amount of money you need to start the mortgage app techniques. Everything concerning the platform will then be laid out wonderfully during the an easy pattern so that you will analyze precisely what the Poor credit Fund brand is about.

In addition to admiring time, your website comes with a very important informative section throughout the financial con, which we shall explore next point.

- You can obtain a poor credit rating loan effortlessly from this system

- Lenders offer loans without needing to look at the credit history

- Aggressive interest levels out-of most lenders

- Demand as much as $ for objective

- 100% protected no-cost service

- High lender system

- And provides usage of third-group non-lender financial companies

- Readily available twenty-four/7

- Protects and you will encrypts a recommendations

#step 3. RadCred – Finest Money No Credit check; Same Go out Approval

If you’re looking to own a lending program having different fund that’s and additionally flexible and you can reputable, you will need not research further.

RadCred will give anything you seek in place of inquiring any questions regarding the the purpose of the mortgage

Through the use of for a financial loan with RadCred, you might be opening the door to numerous solutions just like the RadCred, as a middleman program, tend to hook your with quite a few versatile loan providers  . They are going to get to know and you can assess your financial situation, determining in the event you are capable of getting that loan even instead of checking your credit rating.

. They are going to get to know and you can assess your financial situation, determining in the event you are capable of getting that loan even instead of checking your credit rating.

When you require a safe and you will safer ways to get a preliminary-identity mortgage no questions questioned, please try out RadCred, to see for your self just what precision the platform has the benefit of.

If you don’t want to specify the exact purpose for the loan you want to obtain, then RadCred will be an excellent choice for you. The platform’s lenders offer loans with no questions asked, so you can use the money you obtain for whatever reason you require.

Short-label funds that want no credit assessment are not intended your certain goal, however some lenders may still cost you precisely why you want brand new finances. That have RadCred, your own personal issues will continue to be unknown regarding the application techniques.

Clients’ recommendations towards RadCred mainly used their features to answer financial problems with scientific expenses, overdue bills, late home loan repayments, student loans, plus see payday loans. Taking some mortgage items in the place of a credit score assessment is truly an enthusiastic unbelievable ability of one’s RadCred program.