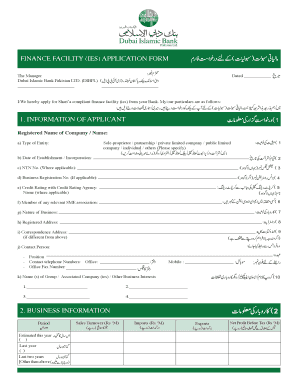

Information Field Criteria

The genuine estate market is constantly switching, plus it helps understand how business conditions may affect your own status as the a purchaser. The agent can give you details fast cash loans in Somerset on newest standards and you will identify the effect on your.

Residential property Transfer Taxes

If you’re to purchase a property within the a big Canadian hub, you’ll want to add residential property transfer taxation into the list of settlement costs.

Unless you live-in Alberta, Saskatchewan, or outlying Nova Scotia, land transfer taxation (or possessions get tax) try part of your house-to find procedure. Such taxes, levied towards the properties that are modifying hand, will be the obligation of your buyer. Based on in your geographical area, fees can vary out of 0.5% to help you dos% of your own complete value of the house or property.

Of many provinces have multiple-tiered income tax options that can appear challenging. If you purchase a house having $260,000 for the Ontario, like, 0.5% are recharged for the earliest $55,000, 1% is billed to the $55,000 so you can $250,000, as $250,000 – $eight hundred,000 variety are taxed in the 1.5%. Their complete tax bill? $2,.

United kingdom Columbia Up to $two hundred,000 X step 1% of overall worth of Off $2 hundred,000 right up X 2% regarding full worth of

Manitoba Doing $30,000 N/A through $30,000 so you’re able to $ninety,000 X 0.5% from total property value Away from $ninety,000 so you can $150,000 X step 1% out-of overall value of Out of $150,000 upwards X 1.5% from full value of

Ontario As much as $55,000 X 0.5% out-of full value of Of $55,000 in order to $250,000 X step 1% of complete property value Off $250,000 so you’re able to $eight hundred,000 X 1.5% away from full value of Out of $eight hundred,000 right up X dos% out-of full worth of

Quebec Around $50,000 X 0.5% off full worth of Away from $50,000 to $250,000 X step 1% regarding full property value Off $250,000 right up X step 1.5% of total value of

Label Insurance Explained

Name So you’re able to Property Title ‘s the court label getting possession regarding property. Customers want “good and marketable” label so you’re able to a property. “An effective term” setting term appropriate for the latest customer’s aim; “valuable identity” means term the customer can also be communicate to others.

Name Insurance policies Before closure, public record information try checked to select the previous possession of one’s assets, in addition to past deals associated with they. The fresh new search you are going to inform you present mortgages, liens for outstanding fees, utility charge, etcetera., registered resistant to the property. From the closing, the buyer wants possessions that is clear of eg claims.

Possibly trouble from identity are not receive before closure. They can make possessions less valuable in the event the buyer subsequently offers, and will pricing currency to fix. Including, the newest questionnaire possess failed to reveal that a pier and boathouse built on a river adjacent a vacation possessions is built instead of permission. The buyer of the home would-be out-of-pouch in the event the he is afterwards compelled to eliminate the dock and you will boathouse. Otherwise, the property might have been conveyed so you can an earlier holder fraudulently, in which particular case you’ve got the chance that the actual proprietor may come submit at some point and you may consult its rights which have regard with the possessions.

Who’s secure having title insurance coverage? Lenders will often require identity insurance policies as the an ailment of developing the borrowed funds. Name insurance handles people and you can/otherwise lenders facing loss or destroy suffered in the event that a declare that is included under the terms of the insurance policy is established.

Sort of dangers which might be usually safeguarded is: survey abnormalities forced elimination of existing formations states on account of ripoff, forgery or duress unregistered easements and liberties-of-means decreased pedestrian otherwise vehicular accessibility the property really works sales zoning challenge non-compliance otherwise inadequacies, etc.