A Trial Balance is a list of all the accounts of a business and their balances; its purpose is to verify that total debits equal total credits. When the total debits and total credits are not equal, it is a clear indication that a mistake has been committed in the journalizing and/or posting process. It will include both debit and credit balances, but no adjusting entries have been salary and wages made yet. It will allow you to spot-check the accuracy of the first step in preparing your company’s financial statements – that is, entering balances from your account ledger into a spreadsheet. As the name suggests, the unadjusted version has entries that are not adjusted or in order, while the adjusted ones are used to adjust the two sides of the ledger – the debit and credit.

How is the Trial Balance Prepared?

If it’s out of balance, something is wrong and the bookkeeper must go through each account to see what got posted or recorded incorrectly. Once all balances are transferred to the unadjusted trial balance, we will sum each of the debit and credit columns. The debit and credit columns both total $34,000, which means they are equal and in balance. However, just because the column totals are equal and in balance, we are still not guaranteed that a mistake is not present. The unadjusted trial balance is prepared to check if all accounts have balances. It helps ensure that all transactions for a given period are accounted for before adjusting entries are made.

What is the approximate value of your cash savings and other investments?

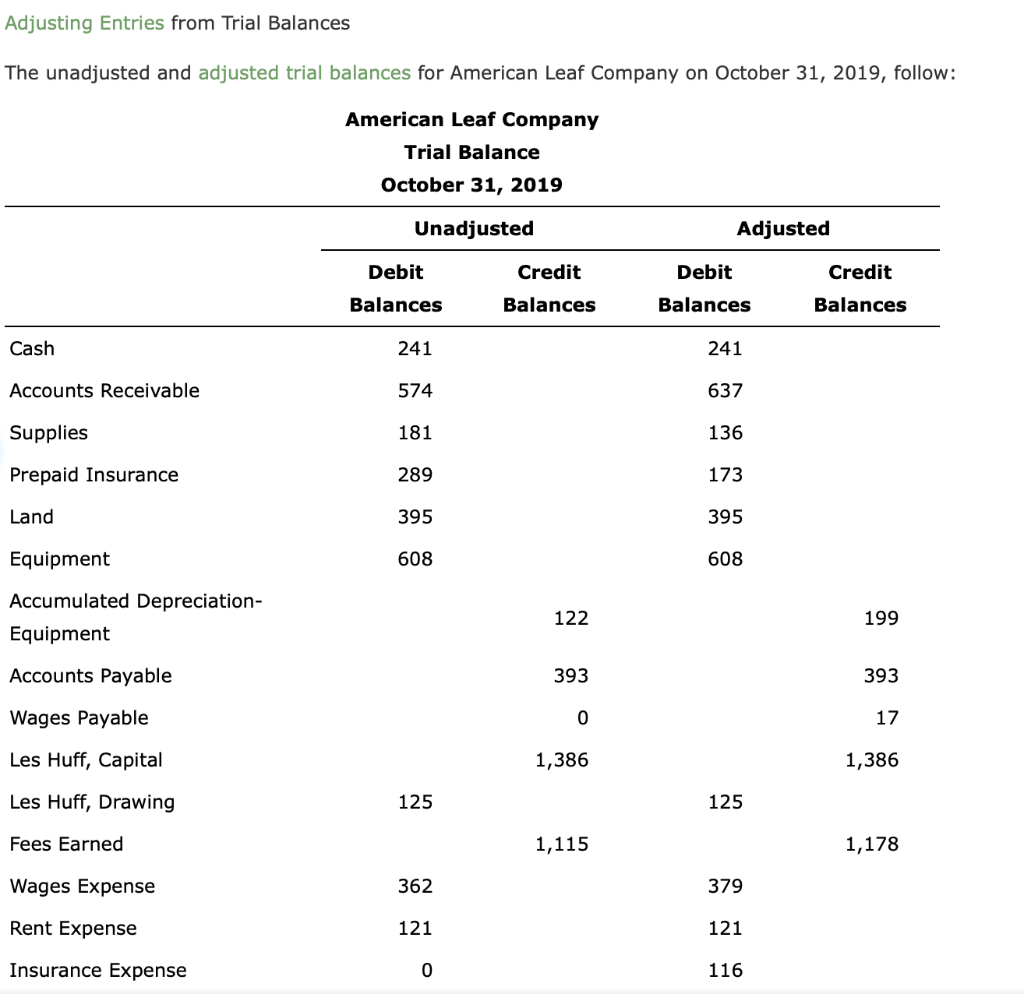

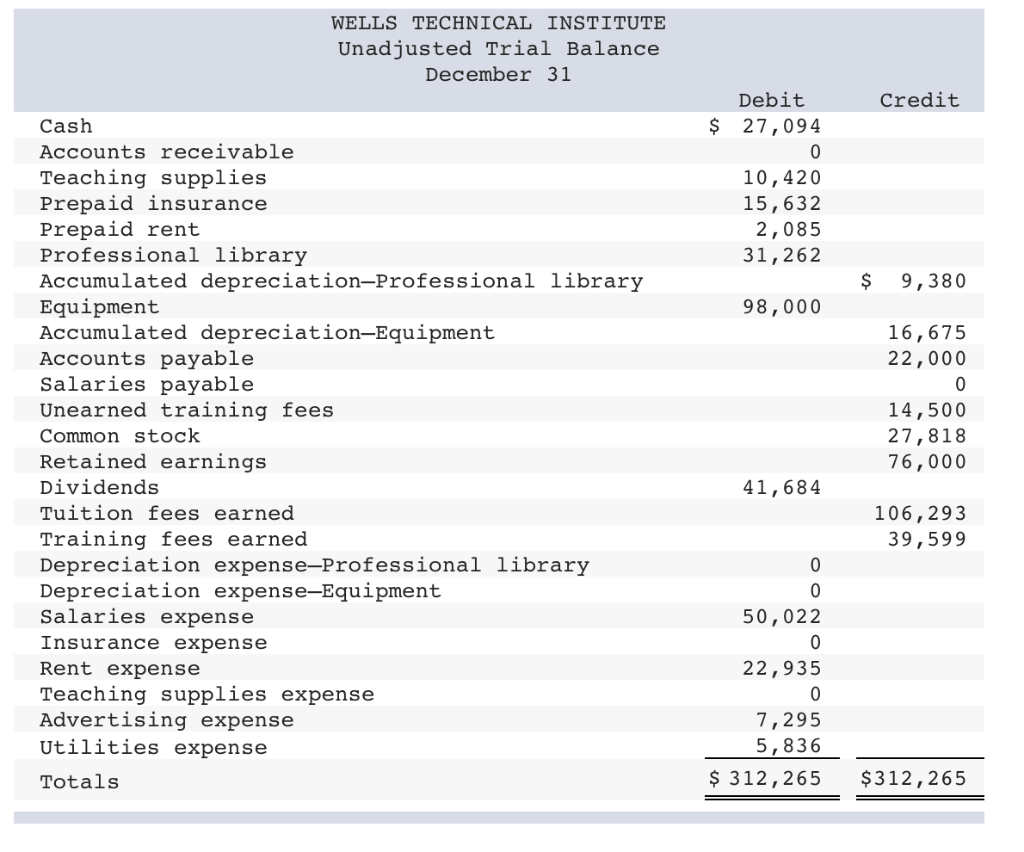

He then took all the balances of each account in the Ledger and summarized them in an unadjusted trial balance which is as follows. Whereas, the adjusted trial balance (ATB) is the same as UTB except that it also includes any adjusting entries made during an accounting period. After the accounts are analyzed, the trial balance can be posted to the accounting worksheet and adjusting journal entries can be prepared. Before computers, a ledger was the main tool for ensuring debits and credits were equal.

Testing the equality of debits and credits

However, just because the column totals areequal and in balance, we are still not guaranteed that a mistake isnot present. After preparing your trial balance this month, you discover that it does not balance. A post-closing trial balance is, as the term suggests, prepared after closing entries are recorded and posted. In the first and second closing entries, the balances of Service Revenue and the various expense accounts were actually transferred to Income Summary, which is a temporary account. The Income Summary account would have a credit balance of 1,060 (9,850 credit in the first entry and 8,790 debit in the second).

Company

² In accrual accounting, revenue and expenses are recorded when they are earned or incurred irrespective of whether the cash is exchanged or not. An unadjusted trial balance is a list of all accounts as of the end of an accounting period. The balances on this trial balance sheet are usually taken from an account ledger or bookkeeping records. However, before every transaction is presented in an organized manner, there is a rough list of transactions accommodated in the unadjusted trial balance.

- Since temporary accounts are already closed at this point, the post-closing trial balance will not include income, expense, and withdrawal accounts.

- It serves to be the source of all financial statements that a company creates.

- Transferring information from T-accounts to the trial balance requires consideration of the final balance in each account.

- The Unadjusted Trial Balance (UTB) document summarizes all of the accounts in an organization at a single point or period.

Our Services

A trial balance plays a major role in the accounting cycle, notably at the end of an accounting period before generating financial statements. Each account with a balance in your accounting system, such as accounts receivable and accounts payable, appears in the trial balance with its respective balance–debits on the left and credits on the right. A trial balance is an internal report that itemizes the closing balance of each of your accounting accounts. It acts as an auditing tool, while a balance sheet is a formal financial statement. Let’s now take a look at the T-accounts and unadjusted trialbalance for Printing Plus to see how the information is transferredfrom the T-accounts to the unadjusted trial balance.

As with the accounting equation, these debit and credit totals must always be equal. If they aren’t equal, the trial balance was prepared incorrectly or the journal entries weren’t transferred to the ledger accounts accurately. After analyzing transactions, recording them in the journal, and posting into the ledger, we enter the fourth step in the accounting process – preparing a trial balance. A trial balance simply shows a list of the ledger accounts and their balances. After an unadjusted trial balance has been adjusted with the year-end closing entries, it is considered an adjusted trial balance.

Bookkeepers typically scan the year-end trial balance for posting errors to ensure that the proper accounts were debited and credited while posting journal entries. Internal accountants, on the other hand, tend to look at global trends of each account. For instance, they might notice that accounts receivable increased drastically over the year and look into the details to see why. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.