Disinflation causes low demand, low production, and an inflated unemployment rate. The ratio in which existing partners settle to sacrifice their profit and loss share in favour of newly admitted partner or partners. Now, it must be noted that sacrificing partners are those individuals whose share of profit decreases with the change in partner’s profit-sharing ratio. On the sacrifice ratio formula other hand, a gaining partner is that individual whose share of profit increments with a change in the partner’s profit-sharing ratio. Sacrificing ratio results in a decrease in the profit-sharing ratio of existing partners. Supply-side economics is one alternative approach that emphasizes the importance of factors affecting the supply of goods and services in the economy.

Economics

If too much time elapses, inflationary expectations will be affected and the ratio will break down. For more information about the influence of inflationary expectations, see my article about the NAIRU . A – Phillips curve presents the effect of reducing inflation on unemployment rates in an economy. So, when inflation falls due to contractionary inflationary measures, unemployment surges.

study guides for every class

This resulted in a significant increase in the sacrifice ratio as unemployment rose sharply. Conversely, in response to the 2008 financial crisis, many central banks pursued expansionary monetary policies to stimulate economic growth and reduce unemployment, potentially increasing the sacrifice ratio. The sacrifice ratio represents the temporary increase in unemployment or reduction in economic output that occurs when a country aims to reduce inflation.

Analyze Investments Quickly With Ratios

These factors include inflation expectations, long-term growth prospects, and the credibility of the central bank. By accounting for these variables, policymakers can ensure that their decisions align with the future trajectory of the economy and promote sustainable economic growth. In recent years, unconventional monetary policy measures have gained prominence as alternative approaches to managing inflation and unemployment. Quantitative easing (QE) and forward guidance are examples of such measures that central banks have employed to stimulate economic activity. By purchasing government bonds or other financial assets, central banks inject liquidity into the financial system, thereby reducing borrowing costs for businesses and households. This, in turn, can stimulate investment and consumption, ultimately leading to job creation.

Sacrifice Ratios and Core Inflation

Conversely, in economies with more flexible labor markets, the adjustment process is quicker and smoother, potentially reducing the sacrifice ratio. While austerity measures were deemed necessary to address the underlying structural issues, they came at a significant cost. The reduction in government spending and increase in taxes resulted in a contraction of economic activity, leading to higher unemployment rates and social unrest in some countries. The sacrifice ratio in this context was evident as policymakers had to make difficult choices between short-term pain and long-term stability.

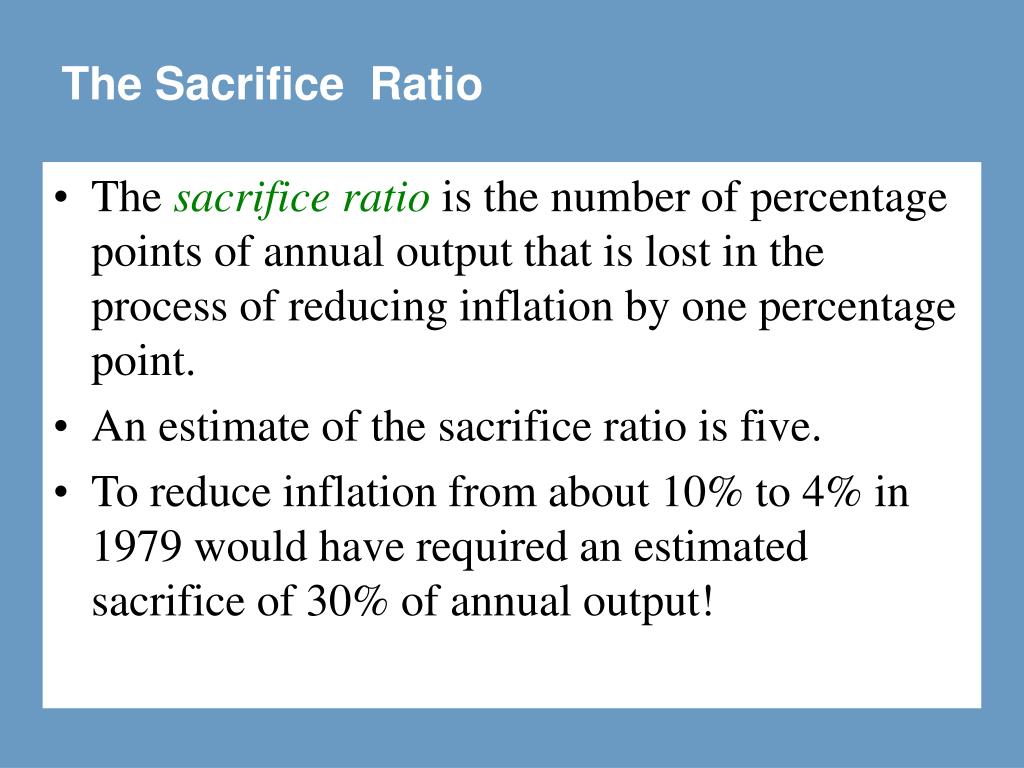

- The sacrifice ratio during this period was estimated to be around 5, indicating that a 5% reduction in output was required for every 1% decrease in inflation.

- This discovery was groundbreaking at the time, as it challenged the prevailing belief that inflation and unemployment could not coexist.

- Critics argue that placing too much emphasis on minimizing the sacrifice ratio may lead to neglecting important long-term considerations, such as sustainable economic growth and stability.

- The sacrifice ratio is sensitive to the specific policy tools and strategies employed to reduce inflation.

Understanding the Sacrifice Ratio

Proponents of this theory argue that policies aimed at reducing barriers to production and increasing productivity can lead to lower unemployment without necessarily causing a significant increase in inflation. For example, tax cuts and deregulation initiatives can stimulate investment and entrepreneurship, ultimately leading to job creation and economic growth. The sacrifice ratio is typically calculated as the percentage increase in the unemployment rate for each percentage point decrease in inflation. For instance, if a country decides to reduce inflation from 10% to 5% and the sacrifice ratio is 2, it means that the unemployment rate will increase by 2 percentage points.

Understanding the significance of the sacrifice ratio helps in formulating effective monetary policies that balance inflation control with minimizing the negative impact on economic output. Raising interest rates to curb spending and increase the savings rate is one of these tools. However, the potential reduction in output in response to falling prices may help the economy in the short term to reduce inflation also, and the sacrifice ratio measures that cost. The sacrifice ratio is calculated by taking the cost of lost production and dividing it by the percentage change in inflation. Understanding the factors affecting the sacrifice ratio is essential for policymakers to make informed decisions. Notwithstanding, the possible reduction in output in response to falling prices might help the economy in the short term to reduce inflation likewise, and the sacrifice ratio measures that cost.

For example, if individuals expect inflation to persist in the future, they may demand higher wage increases to compensate for the expected erosion of purchasing power. This can make it more challenging for policymakers to reduce inflation without significant short-term increases in unemployment. The amount of output lost through cold turkey and gradualism is explained with the help of sacrifice ratio.

Disinflations, or an impermanent easing back of prices, are major reasons for recessions in modern economies. In the United States, for instance, recessions happened in the mid 1970s, mid-1970s, and mid 1980s. Every one of these downturns happened simultaneously as falling inflation because of tight monetary policy.