Many subscribers query when the you can find obligations-to-money requirements that have USDA home loan financing. The newest short answer is yes. Your debt-to-earnings proportion was a qualifying basis to have an excellent USDA mortgage. T

the guy standard testimonial can be your financial obligation-to-income proportion shouldn’t go beyond 43% of the adjusted gross income. Even though it is possible going above this count, it does be the main automated underwriting program in order to find out if your be eligible for an effective USDA home loan.

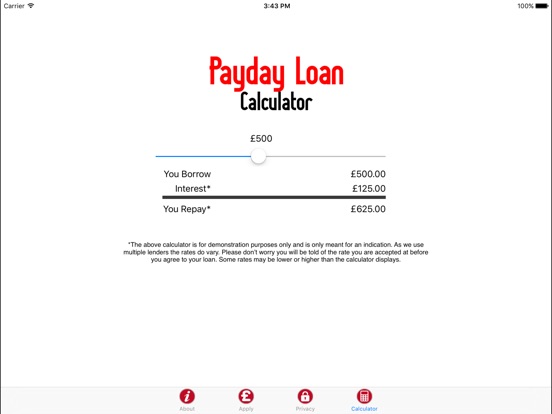

Gustan Cho Couples offers personal loans in Rhode Island a straightforward-to-explore mortgage calculator in order to estimate the front and back-prevent obligations-to-earnings ratios. GCA’s representative-friendly financial calculator offers an estimate on your own mortgage commission.

Thousands of viewers utilize the GCA home loan calculator. The fresh GCA financial calculator is employed from the financing officials, realtors, and you can consumers throughout the real estate industry.

For any issues for the utilizing our state-of-the-artwork mortgage calculator, don’t hesitate to e mail us on Gustan Cho Lovers from the (800) 900-8569 today. Text message you getting a more quickly effect. The latest USDA mortgage calculator gives you a field where you are able to go into other liabilities like your mastercard money, car loan repayments, figuratively speaking, and every other financial obligation you have said into the borrowing from the bank statement.

Carry out Loan providers Possess Other USDA Home loan Requirements

When you have quicker-than-finest borrowing from the bank otherwise higher debt-to-income ratios, you need to focus on a highly skilled home loan people who knows the newest ins and outs of a beneficial USDA home mortgage. Only a few loan providers have a similar financing conditions with the USDA money.

USDA Financial Requirements on Credit scores

Credit history Credit reporting can be very hard to see. The fresh new USDA automatic underwriting system essentially really wants to get a hold of a cards score regarding 640 or maybe more. But not, to purchase a house that have an excellent USDA home loan is achievable even if the credit rating are lower than 640.

If for example the credit history is a lot more than 640, this new automatic underwriting program to possess USDA finance have a tendency to generally speaking give you an endorsement.

Even though many things get into good USDA mortgage, a credit score is extremely important. Gustan Cho Lovers is obviously open to opinion your credit report in more detail. We have been specialists in credit reporting and can give you advice to boost your credit rating in order to be eligible for good mortgage.

USDA Finance To possess Poor credit

We come across all credit history regarding the mid-400s with the middle-800s. There are numerous small things can help you to boost your credit rating. We has arrived supply our very own expert advice. While we usually do not strongly recommend borrowing fix, the audience is constantly ready to advise you to your increasing their credit scores. Borrowers that have less than perfect credit normally qualify for USDA finance.

Generally, when you yourself have less than perfect credit and lower credit ratings, just be sure to inform you almost every other compensating affairs. Example of compensating circumstances take-time payment history, more property regarding bank, durability on your own employment, and you will higher continual earnings..

Rewards So you’re able to a great USDA Financial

Within our thoughts, best perk so you’re able to a great USDA loan is the zero advance payment needs. Regarding the monetary reputation the us happens to be in, saving money are much harder than ever. With inflation more than when you look at the ericans try consuming because of their discounts merely to pay bills.

USDA Home loan Conditions to your Deposit

Just like the a USDA financing doesn’t need a down payment and you may allows owner to spend settlement costs, purchasing a house with little if you don’t no money away from pocket is possible. A beneficial USDA home mortgage enables the vendor to pay upwards so you can six% of one’s price into seller-paid off settlement costs.