It doesn’t reflect the real amount of money you have available to spend. Knowing the ins and outs of gross and net pay is vital if this is your first time running payroll at your company. An employee’s pay stub should always indicate their gross wages, any deductions, and their final net pay amount. Employee contributions made to retirement plans such as 401(k)s will, in most cases, be taken out of their gross pay and reduce their tax liability. If an employer matches employee contributions toward a retirement plan on a pre-tax basis, that employer match won’t impact gross or net pay. For example, if an employee makes $2,600 in gross wages biweekly but deductions each pay period equals $800, their net pay each paycheck will be $1,800.

Featured payroll software offers

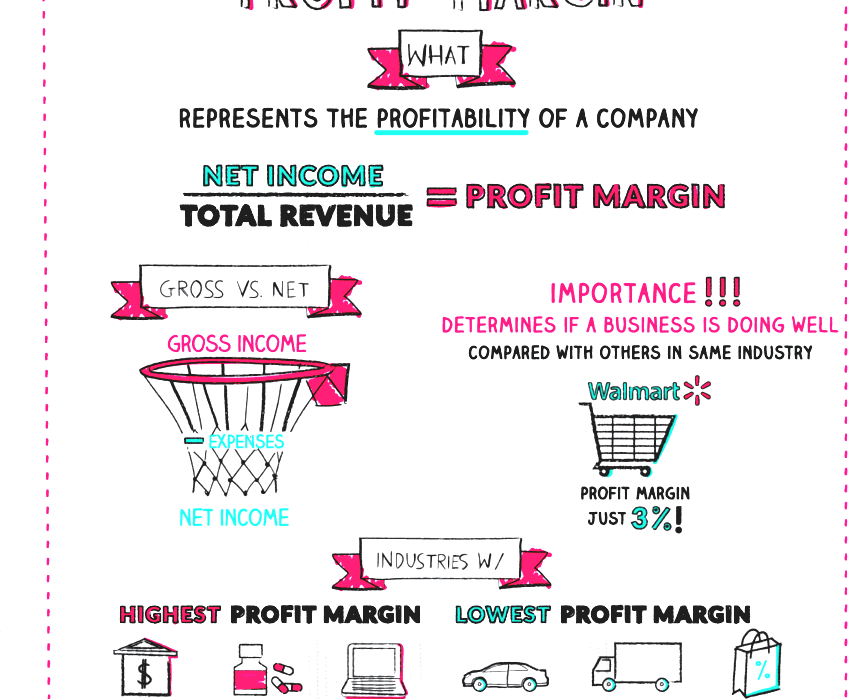

We explore how they are similar and different and how they are calculated. Being aware of your net pay prevents surprises and helps you manage your cash flow smoothly. Understanding the breakdown of your paycheck helps you identify http://sochi2014-sberbank.ru/en/news/128/view/ potential errors in your deductions. It ensures that you’re receiving the correct pay according to tax regulations and benefits contributions. Focusing solely on gross pay can lead to unrealistic budgeting and financial planning.

- Net pay, or take-home pay, is the amount of money an employee receives after their employer makes any necessary payroll deductions from their gross pay.

- This status is not only impacted by where the alimony is awarded, though — when matters, too, as the law may have changed since the judgment was issued.

- If a worker earns $14 per hour for 40 hours per week and gets paid weekly, their weekly gross pay is $560 ($14 x 40).

- Medicare and Social Security taxes make up the Federal Insurance Contributions Act (FICA) taxes, which total 7.65%.

- Net pay, also known as take-home pay, refers to the salary employees get after all the necessary deductions.

- For employers, understanding the two terms ensures accurate payroll.

How to calculate gross income for a salaried employee

To calculate net from gross, you must withhold deductions each pay period. Net pay is the take-home pay an employee receives after you withhold payroll deductions. Mandatory deductions are required by law and include federal, state, and local income taxes, Social Security (6.2%), Medicare taxes (1.45%), and state unemployment taxes.

Calculating Taxes and Deductions

Compared to gross pay, which is before deductions, net pay shows your earnings after taking out all deductions. Employers only need to report HRA allowances if they accidentally reimburse an employee who doesn’t have minimum essential coverage (MEC). Otherwise, only the qualified small employer HRA (QSEHRA) has W-2 reporting requirements. Instead of reporting a QSEHRA allowance as gross income, employers report it in Box 12 with code FF. As you can see, the concepts of net pay and gross pay are foundational to understanding how to do payroll.

- The employee portion is 6.2% of gross pay for Social Security taxes and 1.45% of gross pay for Medicare taxes.

- The key difference between gross pay and net pay is that gross pay includes no taxes or deductions, while net pay is the take-home amount after taxes and deductions have been applied.

- In some cases, an employee may also have non-tax mandatory deductions.

- In this article, we’ll explore your gross wages vs. net pay, their basic components, and how to calculate them.

- After all such considerations are made, the bet pay calculator is used to calculate the salary-in-hand for the employee.

Finally, you can use this figure to find your gross annual income by multiplying it by the 12 months of the year. In interviews, you will also refer to your gross pay when being asked about your salary requirements. In this article, we’ll teach you the difference between gross and net pay and how to calculate each one.

Gross Pay vs. Net Pay: Understanding Your Paycheck

The gross pay is the total amount of money an employee earns before any deductions are taken out. The net pay is the amount they take home after those deductions have been made. If you’ve ever wondered why your gross pay is higher on your paycheck than the amount that shows up in your banking account, you’re certainly not alone.

For employers, understanding the two terms ensures accurate payroll. For employees, it allows you to see where your earnings are going and catch any discrepancies. When you http://nerzhul.ru/technology/336.html bring on a new employee at your small business, one of the key concepts to master in understanding how payroll works is the difference between gross pay and net pay.

Small Business Resources

Keep in mind that some of these deductions are pre-tax while others are post-tax. State income tax rates vary by state, and not all states have income taxes. Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Washington, and Wyoming do not have state-level income tax. Benefits like tips, some forms of expense reimbursement, educational spending not required for your job, and certain life insurance policies may be included in your gross pay.

What Deductions Are Made From Gross Pay?

It’s important to keep in mind that overtime pay may need to be factored in for hourly employees who work more than 40 hours per week. In the United States, overtime pay is generally calculated at a rate of 1.5 times the employee’s https://pesnibardov.ru/f/viewtopic.php?f=4&t=6440&view=next regular hourly rate for any hours worked over 40 in a single workweek. Calculating gross pay for hourly employees involves multiplying the employee’s hourly rate by the number of hours they worked during the pay period.